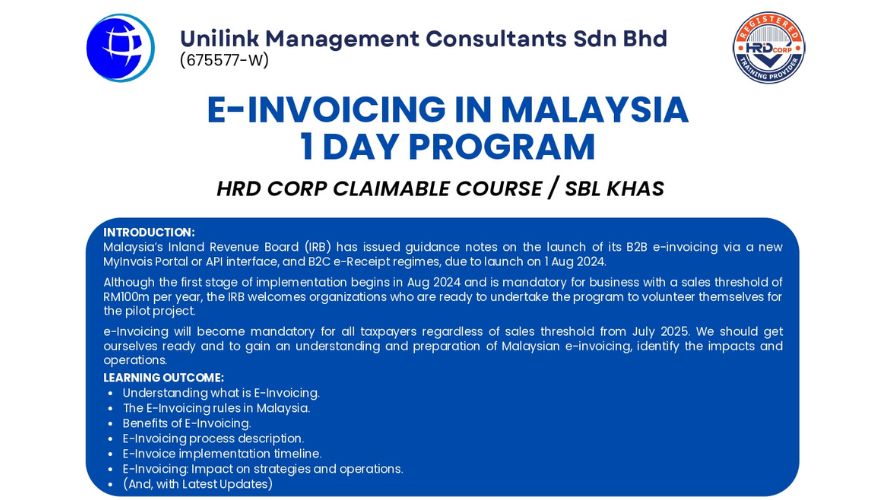

Malaysia’s Inland Revenue Board (IRB) has issued guidance notes on the launch of its B2B e-invoicing via a new MyInvois Portal or API interface, and B2C e-Receipt regimes, due to launch on 1 Aug 2024. Although the first stage of implementation begins in Aug 2024 and is mandatory for business with a sales threshold of RM100m per year, the IRB welcomes organizations who are ready to undertake the program to volunteer themselves for the pilot project. e-Invoicing will become mandatory for all taxpayers regardless of sales threshold from July 2025. We should get ourselves ready and to gain an understanding and preparation of Malaysian e-invoicing, identify the impacts and operations.

Overview

- Category: Taxation

- Trainer / Training Provider: Macks Ong

- Training Method: Instructor-led Training

- HRDCorp Claimable: Yes

- Target Audience: business owner and director, CFO & Finance Personnel , COO , Business Managers impacted by e- invoicing implementation

- Past or Up-coming Training: Past Training

- Date: 20/08/2024